The first thing a Formula One driver would do when he/she started to earn some serious money would be to leave the UK. Can you blame them? If you had an annual salary of over £10m, of which you were taxed 45% by the Inland Revenue, and had an estimated worth of £88m, you would probably consider ways of protecting your income and avoiding income tax.

I haven’t spoken with a Formula One driver in any great detail about their relocation strategy, but I can imagine the criteria when looking for a new house would look something like this;

1. Warm

2. A mooring for your luxury yacht.

3. No income tax

4. Low crime

5. Exclusive

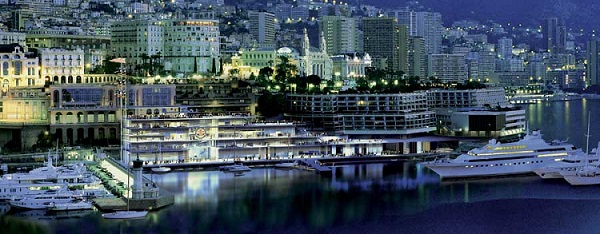

So a spot in Monte Carlo, a small state at the heart of the French Riviera that ticks all the boxes and saves you from parting with your well-earned cash would do just the job?

Rather than giving money to HMRC you would be able to service your multi-million pound yacht, apartment and transport. Monaco delivers for the super-rich and has managed to maintain its policy of not charging residents income tax, much to the disappointment of international “good society”.

For our small business clients, avoiding their fair share of tax is simply not an option. Upping sticks to a tax free bolt-hole isn’t part of their 5 year growth plan. Increasing their turnover and improving their client interaction is, and that is where a good, professional accountant comes in handy.

An accountant allows a business to push ahead, developing marketing strategies and innovating under stricter financial guidelines which allows for growth and higher chances of sustained success.

So whilst we admire the success emerging British superstars, we also acknowledge that SMEs need accountants, and accountants need SMEs. Good accounting is good business and if you would like to find out more, then speak to AIMS.

An AIMS accountant is never far away.

If you like the way we think – you will like the way we work.

AIMS Accountants for Business are the largest independent association of professionally qualified accountants in the UK specialising in accountancy for small, local and independent businesses. AIMS are no ordinary accountants and we are more than just number crunchers! Find your local AIMS Accountant.