All AIMS Accountants are fully qualified accountants. They must also be eligible for a practising certificate. These are things that we require because we want our customers to know that they are getting work of the highest quality. Below, we look at the four main accountant qualifications that are sure to increase your employability. These qualifications will also enable you to set up your own practice with AIMS!

Before that, a disclaimer. These leading accountant qualifications change regularly. The criteria today will probably be different in six months. The entry routes and levels may also have changed so make sure that you check the respective websites for up-to-date information.

The accountant qualifications that I’m focusing on are the four most sought-after: ACA, CGMA, ACCA, MAAT.

Let’s begin with the ACA qualification that is offered by the Institute of Chartered Accountants of England and Wales (ICAEW). This is a unique qualification in that you must complete exams while also training on the job. The ICAEW have lots of options for people in very different situations. Let’s begin with people who don’t want to go to university:

It is important to note that completing the CFAB helps you gain credits towards the ACA qualification but it does not alone mean that you will be qualified.

The ICAEW has also teamed up with the AAT to help people progress onto the ACA much quicker. If you have the AAT qualification, you should check this route out!

There are also a range of options for graduates:

The joint programme with the CIOT will help you if you want a career in tax accountancy. It will mean that you don’t study certain subjects twice, helping you to qualify more quickly. One thing to note here is that businesses who support the ACA qualification do not only look for students with finance degrees. These businesses look for people from a range of backgrounds including chemists, historians and physicists!

Any of the above options will help you achieve the ACA qualification which becomes FCA after 5 years of practice as an accountant after qualifying.

Next, let’s look at the Chartered Institute of Management Accountants (CIMA) who offer the Chartered Global Management Accountant (CGMA) qualification. This qualification is split into three levels:

On average, it takes around four years and most people also have at least three years of relevant practical experience. Completing the operational level will enhance your short-term decision making and will award you the CIMA Diploma in Management (CIMA Dip MA). Finishing Management level will help you translate long-term decisions into medium term plans. You’ll be awarded the CIMA Advanced Diploma in Management Accounting (CIMA Adv Dip MA). Finally, the Strategic level will focus on long-term strategic decision making which will really enhance your employability at senior levels of business. Once completed, you must demonstrate that you have at least three years of relevant work experience. If accepted, you’ll now be able to use the letters CGMA after your name!

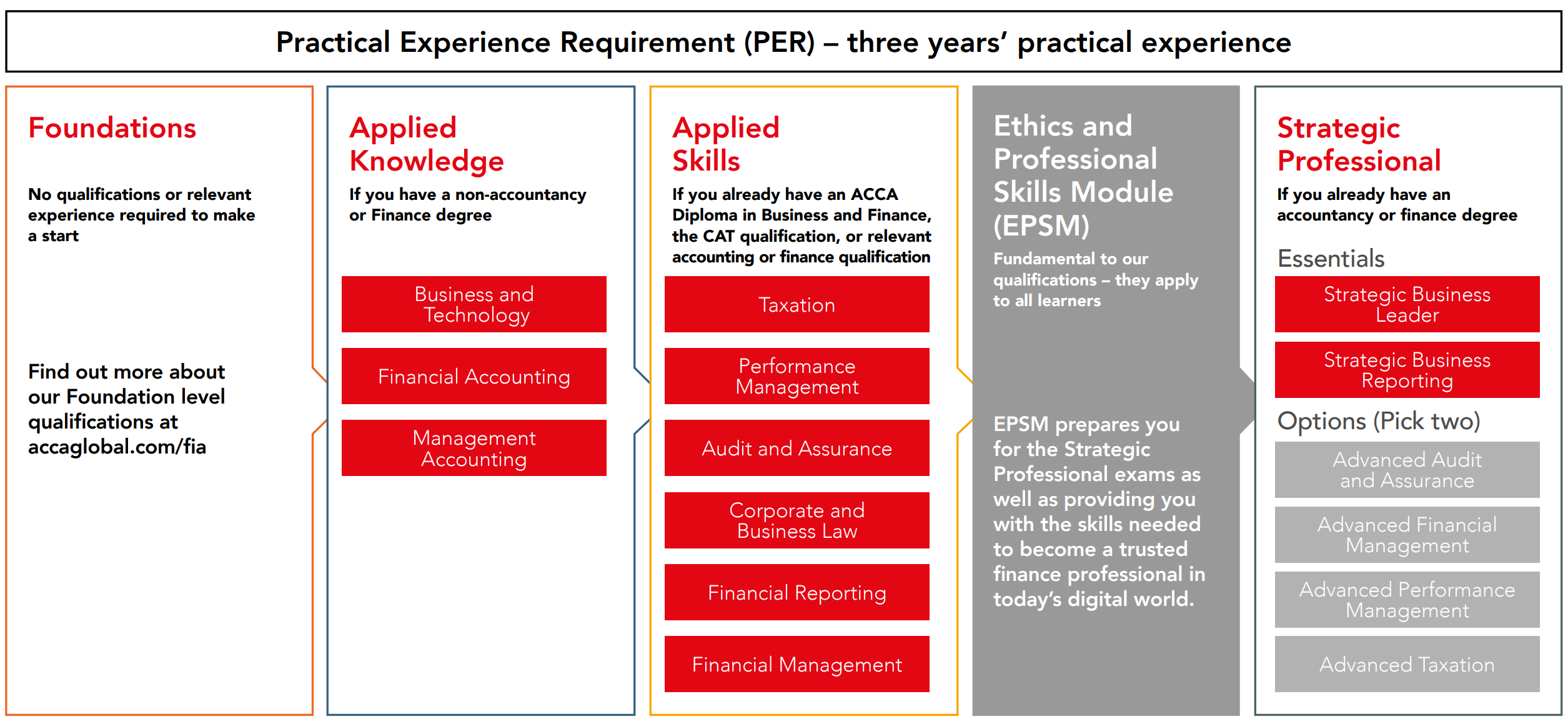

The Association of Chartered Certified Accountants (ACCA) have over 200,000 members worldwide. It is one of the most widely sought-after accounting qualifications. There are various starting points, so have a look at the image below to see where you might be able to start!

If you have no qualifications, a great place to start would be with ACCA’s Foundations in Accountancy qualifications:

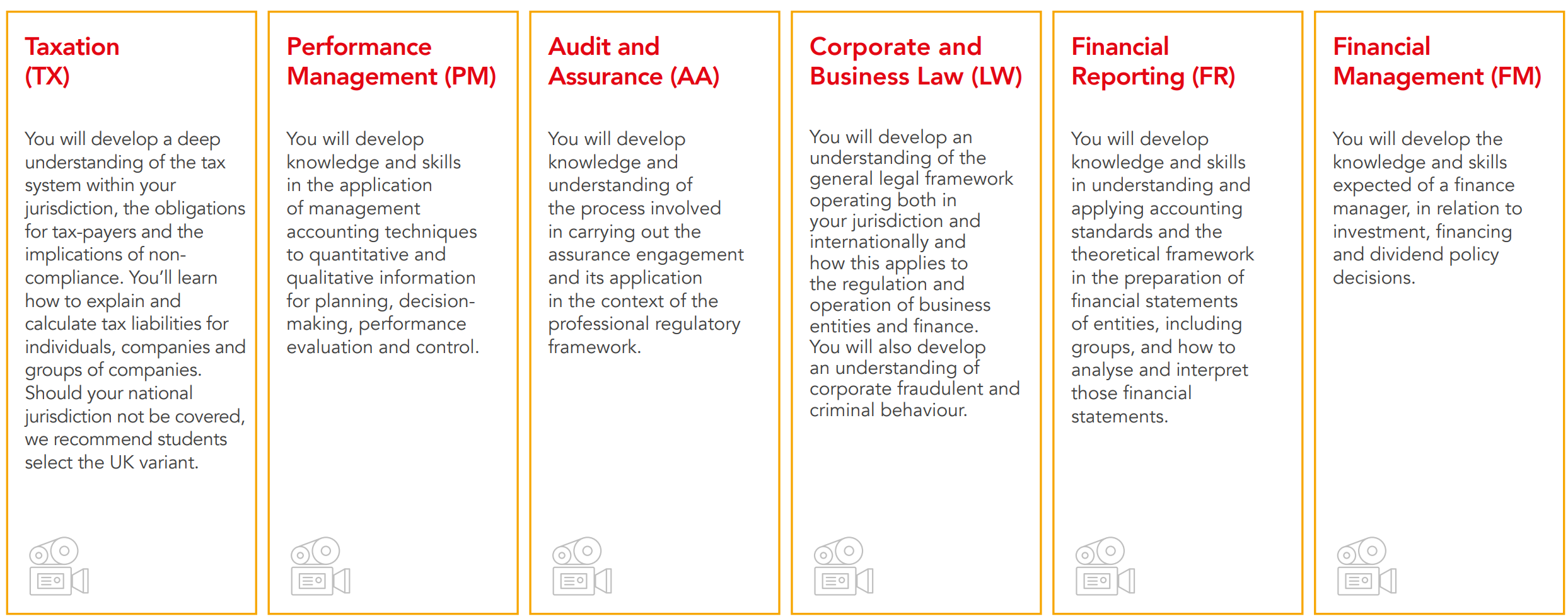

Completing these qualifications will help you get a job as a trainee accountant. For those who are wanting to progress further, you must complete 6 more exams in the Applied Skills section:

Completing these exams will give you an Advanced Diploma in Accounting and Business. The ACCA also have a scheme with Oxford Brookes University to help people achieve this! Finally, you must complete the Ethics and Professional Skills module and the final 6 elements of the Strategic Professional module.

The ACCA boast 501 exam centres in 148 countries. They also have 348 quality-checked tuition providers, meaning that you are probably close to someone who can help you achieve this qualification! After 5 years of practical experience post-qualification, you become an FCCA accountant.

“Every year 80,000 people discover the value of an AAT qualification.” This is what the AAT claim on their website. They have a fantastic reputation in the accounting world among employers. We mentioned earlier that the ICAEW have a joint programme with the AAT alongside their ACA qualification, but you can also become an AAT qualified accountant independent of any other organisation. There are 3 levels that you must go through to become fully qualified and start achieving senior roles in business:

To achieve the MAAT letters after your name, you must have completed level 4 and done one of the following:

If you are currently studying any of these qualifications, keep AIMS in mind for when you’re fully qualified! You can also find out more about us here.

If you have any of the qualifications listed above and you want to become an AIMS Accountant now, please contact James on 020 7616 6622!