Have you ever considered the implication of making a mistake on your tax return? Mistakes are treated differently by HMRC depending on whether they believe that the mistake was accidental or deliberate. Filing late also attracts penalty, so that’s a mistake you can avoid very easily by getting started now.

HMRC awards penalties depending on the following:

· Late filing penalty

· Late payment penalty

· Penalty for inaccurate returns

· Penalty for failure to notify

The basis of calculation of this penalty is a two-stage process:

1. Calculate the potential lost revenue. This is the extra tax due as a result of correcting the inaccuracy

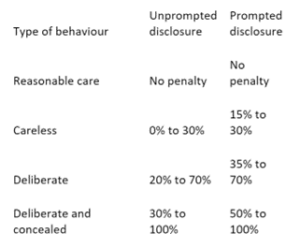

2. Calculate a percentage, based on the taxpayer’s behaviour as explained on this table:

The exact whereabouts on the scale depends on the quality of the disclosure provided by the taxpayer.

There are no penalties for “innocent” tax errors, the boss of HM Revenue & Customs (HMRC) has said. This means the taxpayer took reasonable care completing their tax return. The meaning of this will vary depending on the capabilities and circumstances of the taxpayer and the complexity of the issues affecting them and whether they are represented.

Company directors are expected to be able to demonstrate ‘reasonable care’ in the tax affairs. That means keeping appropriate tax records and submitting complete and factually correct tax returns. The onus of proof of careless behaviour is on HRMC and when assessing carelessness, HRMC look at how significant the error is in the context of tax liability, and extenuating circumstances like ill health. Penalties range between 0 and 30% of lost revenue, but tend to be at the higher end if HRMC uncovers the mistake rather than the business declaring the mistake themselves.

Again, HRMC has to prove that the mistake was deliberate. Evidence suggests that HRMC is tougher than it used to be in this matter, with over 100,000 inaccuracy penalties issues in 2022 which is considerably higher than any other year. Of these, 11,000 were due to deliberately inaccurate returns being returned.

The penalty also increases, at between 30 – 100% of the potential lost revenue if HRMC also believes that the mistakes were concealed.

Deliberate and concealed mistakes are those where HMRC finds evidence that someone has either falsified documents, or made other sorts of deliberately false representation to conceal their true tax situation. Your penalty could be up to 100% for these errors.

Errors in this category can also lead to a criminal investigation and jail time.

As always, contact your local AIMS Accountant if you want further clarification about your tax situation, or if you think your tax return is inaccurate.