Our ex-chancellor, Mr Zahawi, has gained some unwanted attention and lost his job regarding the penalty that he recently paid for a “careless and not deliberate” mistake on his tax return. The Press reported the penalty to be 30%. If you make mistakes on your tax return, you will likely face a penalty and sometimes, they can be severe.

But how does HMRC decide what penalty to give?

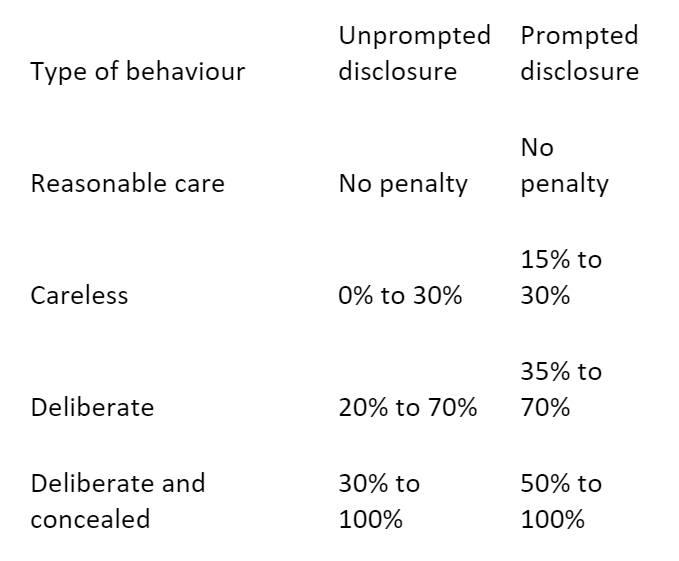

First you need to identify the type of offence, as this will determine the kind of penalty. These are the main penalty categories for self-assessment errors:

In Zahawi’s case, he had filed the return, but HMRC found an error. This is a penalty for an inaccurate return.

The basis of calculation of this penalty is a two-stage process:

The exact whereabouts on the scale depends on the quality of the disclosure provided by the taxpayer.

There are no penalties for “innocent” tax errors, the boss of HM Revenue & Customs (HMRC) has said. This means the taxpayer took reasonable care completing their tax return. The meaning of this will vary depending on the capabilities and circumstances of the taxpayer and the complexity of the issues affecting them and whether they are represented.

This is where Zahawi found himself on the penalties scale. HMRC defines ‘careless’ as a “failure to take reasonable care.”

HMRC understand that someone who is self-employed might not have the same level of expertise as a multi-national corporation, so this is taken into account when deciding if something is truly careless or not.

Zahawi admitted that he made a careless mistake to disclose information and HMRC have treated it so, giving him a 30% penalty (ignoring the fact that his penalty related to an offshore matter where the standard penalty rates applied can be higher depending on the country involved).

Remember, 30% is charged on the potential lost revenue to the HMRC, so if the error results in a tax refund, you will not pay a penalty.

A major difference between careless and deliberate errors is that deliberate errors are considered conscious errors. Yes, the burden of proof is on HMRC, but they will not hesitate to impose strict penalties.

You could pay a penalty of up to 70% if HMRC find your errors to be deliberate. The Finance Act 2008 sets out what deliberate means so you can read about it in more detail here.

Deliberate and concealed mistakes are those where HMRC finds evidence that someone has either falsified documents, or made other sorts of deliberately false representation to conceal their true tax situation. Your penalty could be up to 100% for these errors.

Errors in this category can also lead to a criminal investigation and jail time.

Clearly, HMRC do not mess around when it comes to mistakes on your tax return. This is why it’s important to seek professional advice before doing anything. All AIMS Accountants are fully qualified which means they’ve gone through rigorous training to help you avoid serious penalties like those described above.

You can find your nearest AIMS Accountant here.